01 Oct Changes to the First Home Guarantee – Starting October 1st

The First Home Guarantee allows eligible buyers to purchase a home with just a 5% deposit, without needing to pay Lenders Mortgage Insurance. Some major changes to the scheme, coming into effect in October, could get you settled in your first home easier, cheaper and sooner than ever before.

With home prices rising, it’s not easy to put together funds for a 20% deposit, since its launch in 2020, the first home guarantee scheme has helped more than 230,000 first home buyers get into their own home without decades of saving – and with the recent changes to the existing scheme, it’s become even more accessible by removing many of the restrictions and limitations to eligible buyers.

Key Features Starting October 1, 2025

- Unlimited Places

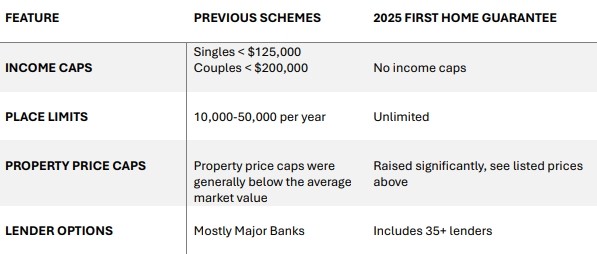

There will be no cap on the number of guarantees issued. Previous versions of the scheme had annual limits (e.g., 50,000 places).

- No Income Caps

All first home buyers are eligible, regardless of income. Earlier schemes excluded singles earning over $125,000 and couples over $200,000.

- Higher Property Price Caps

Price caps have been significantly increased to reflect current market conditions:

- Regional Access Simplified

The separate Regional First Home Buyer Guarantee will be merged into the main First Home Guarantee, making access easier for regional buyers.

- Expanded Lender Network

More participating lenders. Customer-owned and regional banks will be included, increasing competition and choice for borrowers to suit their needs.

- Fast-Tracked Launch

Originally planned for 2026, the scheme will now begin on October 1, 2025.

Comparison with Previous First Home Buyer Schemes

The changes to the scheme represent a major shift in accessibility. For example, a buyer in Sydney can now purchase a $1.5 million home with just a $75,000 deposit, rather than putting down a $300,000 (20%) deposit for the same property.

If you’ve been thinking about buying your first home, now could be the perfect time to take advantage of the expansion of the first home guarantee. Whether you’re ready to get started or just want to explore your options, we’re here to help get your foot in the door.

Feel free to reach and contact any of our team by booking a call.

No Comments